How is gratuity Calculated/ Calculate in India The Gratuity Calculation online would calculator the gratuity amount based on the formula

Gratuity

Gratuity is the monetary benefit an employee receives by the company. It is paid as gratitude when he/she leaves the organization. Gratuity payments provide retirement benefits to the employees. However, the employee should complete five years of service in that company to be eligible for gratuity. how is gratuity calculated in india A gratuity calculator helps in calculating the gratuity amount a person will receive.

What Is Gratuity in Salary?

Gratuity is a financial component offered by an employer to an employee in recognition of his/her service rendered to an organization. gratuity calculator online It is a part of the salary an employee receives and can be viewed as a benefit plan designed to aid an individual in his/her retirement.

Gratuity is paid by an employer when an employee leaves the job after serving the same organization for a minimum period of 5 years. One can consider it to be a financial “Thank you” to an employee for rendering continuous service to an employer.

What is a Gratuity Calculator?

Gratuity calculator is a tool to estimate the gratuity amount one receives if they are planning to leave the job. It is a helpful tool for those employees who are planning to retire from their job. how is gratuity calculated in india The gratuity calculator works on a formula that uses several inputs. These include last drawn monthly income, the number of years of service (including months) and dearness allowance. The calculator returns the gratuity amount within seconds, and it is straightforward to use. It is free to use multiple times. Also, the calculator helps in long term financial planning to have a stress free retirement.

What is Gratuity in India?

Gratuity is the monetary benefit an employee receives in lump sum by the company. The company pays it as a gratitude for his/her services to the company. The motive behind gratuity payments is to provide retirement benefits to the employees. The Payment of Gratuity Act, 1972 governs the gratuity and its payment rules. Under this Act, an employee has to fulfill specific criteria to be eligible for gratuity payment. The employee must work for at least five years in the company continuously. The employee must not have another full-time employer. In case of death or disability of the employee, even before completion of 5 years, the employee is eligible for gratuity. The gratuity amount cannot exceed INR 10 lakhs. The excess, if any, falls under ex-gratia. Ex-gratia is a voluntary contribution and not compulsorily imposed by law.

The number of months of service is significant in gratuity calculation. In the last year of employment, if the employee works for more than six months, it is rounded off to the next number. For example, if an employee works for 15 years seven months, the number of years of service will be 16 years. However, if the employee works for only 15 years and five months, the number of years of service will be 15 years.

The Payment of Gratuity Act, 1972, prescribes rules for the calculation of gratuity. Under these rules, there are two categories of employees. Namely, how is gratuity calculated in india employees covered under the Act and employees not covered under the Act. The Act also lists criteria for the organizations that fall under the purview of the Act.

Also Read : Funny And Shocking Photoshop Mistakes That Should Never Have Been Posted Online

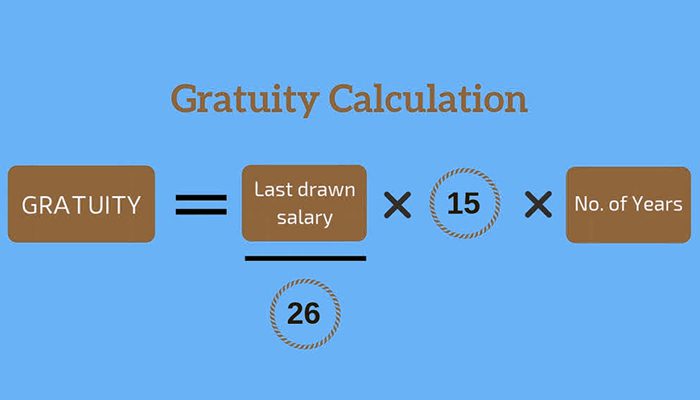

Gratuity Calculation Formula

The Payment of Gratuity calculate Act, 1972, prescribes the rules and calculation of the Gratuity Amount. The Act classifies the employees under two categories:

- Category 1: Employees covered under the Act

- Category 2: Employees not covered under the Act

The above-mentioned categories apply to both private and government employees. However, for government employees, the pay structure varies and hence has additional heads to be account for.

How to Calculate Gratuity?

Using the Gratuity Calculator Formula, one can determine the gratuity amount.

Gratuity (G) = n*b*15/26

n = The number of completed years in the current organization

b = the Last drawn basic monthly salary (plus dearness allowance, the commission received on sales, if any)

Note:

Gratuity considers the number of working days in a month as 26

Gratuity calculates wages at the rate of 15 days

Now, let us see how to calculate gratuity for both the above-mentioned categories.

Category 1: Employees covered under the Payment of Gratuity Act

To calculate gratuity for employees under this category, the formula is:

Gratuity (G) = n*b*15/26

The formula is based on a last-drawn salary of 15 days for each year of service completed or part of it exceeding six months.

For example, Ms. Arya is an employee at ABC Pvt. Ltd. for seven years and three months. Her last payslip amounts to INR 1,00,000. The total amount of gratuity she would receive is

Gratuity = 1,00,000*7*(15/26) = INR 4.03 Lakhs

In the above example, the year of experience is seven years. This is because Ms. Arya worked for less than six months in the year. Similarly, in a scenario where years of experience exceed 6 months in a year. Then eight years would be consider for computation.

Category 2: Employees not covered under the Payment of Gratuity Act

Employees associated with organizations not covered under the Act are also eligible for gratuity. There is no restricting law that stops an employer from paying gratuity to its employees. Even though the organization is not covered under the Act. The formula applicable for this category is:

Gratuity (G) = n*b*15/30

The amount of gratuity payable to the employee is calculate based on half a month’s basic salary for each completed year.

For example, Mr. Sachin works for XYZ Pvt Ltd. Company for ten years and nine months. His latest basic salary drawing is INR 85,000. The gratuity amount that he is eligible for is

Gratuity = 85,000*10*(15/30) = INR 4.25 Lakhs

In this category, the number of years is taken based on each completed year. Though Sachin work with the company for ten years and nine months. How is gratuity calculated in india his tenure is consider as ten years and not 11.

Also Read: Best Funny Math Jokes and Math Puns for Kids

What are the Eligibility Criteria for Payment of Gratuity?

To receive the gratuity, you must meet the following eligibility criteria:

- You should be eligible for superannuation.

- You should have retired from service.

- Thirdly You should have resigned after continuous employment of five years with the company.

- In case of your death the gratuity is paid to the nominee, or to you on disablement on account of a sickness or an accident.

How to Use the Clear Tax Gratuity Calculator?

Follow these steps and calculate your gratuity using the Clear Tax Gratuity Calculator:

- You must enter the basic salary and the dearness allowance if applicable, using the slider.

- You then enter the number of years of service with the company.

- The gratuity calculator would calculate the total gratuity amount payable to you in seconds.

- You can recalculate the gratuity anytime, by changing the input sliders.

- The gratuity will be calculated instantly when you move the sliders.

Benefits of Using the Clear Tax Gratuity Calculator

The Clear Tax Gratuity Calculator is an easy-to-use generic tool, where you enter the basic salary and the years of service. How is gratuity calculated in india It gives you an estimate of the gratuity you would receive, after five or more years of continuous service.

The gratuity calculator shows you the gratuity figures in seconds. gratuity calculator online It helps you plan your finances by investing the gratuity in a smart manner, for a maximum return.

how is gratuity calculated in india You can use the gratuity calculator from the comfort of your home or practically anywhere to get the gratuity amount.

What are the Taxation Rules for Gratuity?

The tax treatment of the gratuity amount depends on the type of employee who has to receive the gratuity.

- The amount of gratuity received by any government employee (whether central/state/local authority) is exempt from the income tax.

- Any other eligible private employee whose employer is covered under the Payment of Gratuity Act. Here, the least of the following three amounts will be exempt from income tax:

- Rs 20 lakh.

- The actual amount of gratuity received.

- The eligible gratuity.

For example, your employer had paid you a gratuity of Rs 12 lakh. As per the gratuity calculation in the earlier example, you are eligible for a gratuity amount of Rs 2,59,615. The government has set Rs 20 lakh as the upper tax-free limit. The lowest of the three figures is Rs 2,59,615, which is exempt from tax. You must pay tax on the remaining amount of Rs 9,40,385 as per your income tax slab.

Do note that in your entire working life, the maximum tax-exempt gratuity amount you may claim, cannot go beyond Rs 20 lakh.

How can a Gratuity Calculator help you?

Upon meeting the eligibility criteria for Gratuity of:

- Age of superannuation

- Five years of employment at the current organization

- Have no other fulltime employment

The user can use the Gratuity Calculator Online in India to determine the Gratuity Amount. Following are the benefits of using the calculators:

- Determining the accurate gratuity value.

- The results are fast, and the calculator is available for free.

- Online gratuity calculators save time from doing the calculations manually.

- The calculator can be accessed from anywhere at comfort.

- It helps in long term financial planning. It is essential to invest the amount wisely rather than holding the amount in a savings bank account. The returns from savings bank accounts do not beat the inflation rate. Therefore results in negative returns. Hence, investors need to invest their gratuity amount to earn significant returns.

Eligibility for Gratuity in India

To be eligible to receive gratuity benefits, the employee must fit into the following criteria:

- The individual must be eligible for superannuation.

- The individual must have resigned from the job after working for 5 years continuously

- He/she should not have any other full-time employer.

- He/she must be retired from the job.

In case of death, disability, or sickness of the individual, there is an exception to the five years criteria.

Payment of Gratuity

Gratuity is a lump sum amount paid at the time of retirement to employees as gratitude after completion of 5 years of service. There is no fixed percentage provided by law for calculating the actual gratuity calculation amount. However, the gratuity amount depends on two things.

- The last monthly salary or basic pay drawn

- The number of years of service

These two inputs help calculate the gratuity calculation amount. Also, the gratuity calculator makes it easier to calculate the gratuity amount.

The gratuity payments can made in cash, cheque, or demand draft. However, to receive the gratuity amount, the eligible employee has to apply within 30 days from the dates it becomes payable. Also, the employer must pay the employee within 30 days from the date of receipt of the application.

Which organization is eligible for Gratuity?

The Payment of Gratuity Act extends to the whole of India. It shall apply to:

- Firstly Every factory, mine, plantation, port, and the railway company

- Every shop or establishment within the meaning of any law. In which ten or more employees are employ or were employ on any day of the preceding 12 months.

- Thirdly Every shop or establishment in which ten or more employees are employ or were employ on any day of the preceding 12 months as the central government may specify.

In other words, any organization having ten or more employees on a single day in the last 12 months comes under the purview of the Payment of Gratuity Act, 1972.

Income Tax & Exemptions on Gratuity

Gratuity received by an employee is taxable under the head ‘Income from Salary’. The Income Tax department, under the Income Tax Act, has declared gratuity tax-exempt up to a certain limit. They are different for government employees, non-government employees covered under the Act, and non-government employees not covered under the Act.

For government employees, the entire gratuity amount is fully exempt from tax.

For non-government employees covered under the Act, the maximum tax exemption is least of the following:

- 15/26* last drawn salary x completed a year of service or part thereof in excess of 6 months

- INR 20,00,000 is the gratuity limit

- Gratuity received

For non-government employees not covered under the Act, the maximum tax exemption is least of the following:

- Half month’s average salary x Completed years of service

- INR 10,00,000 is the gratuity limit

- Gratuity received

All employees have to comply with the Income Tax Department regulation for the purpose of tax filing. The Income Tax Act prescribes the rules for tax filing. For income tax calculations one can use Scrip box income tax calculator. gratuity calculator online The income tax calculator is available online and is free to use.

Where can one invest the lump sum gratuity calculation amount received?

The lump sum gratuity amount one receives can invest in the following saving schemes or investment plans.

- Senior Citizens Saving Schemes (SCSS): Senior Citizens Saving Schemes are safe retirement investment plans. It is one of the post office savings schemes. gratuity calculator online Investments up to INR 1.5 Lakhs are eligible for tax exemption under Section 80C of the Income Tax Act. Investment in SCSS plans can help in tax savings.

- Fixed Deposits: For decades fixed deposits have been Indians’ best savings options. The current FD interest rate varies around 5.5% – 7.5%. Also, investors can use any of the online FD calculators to determine the returns.

- Debt funds: Debt mutual funds invest across various securities like money market instruments, corporate bonds, government bonds, gratuity calculator online and other government securities. The capital gain tax of debt funds depends on the investment holding period. Debt funds for less than three years attract Short Term Capital Gains Tax is add to the taxable income of the investor. While Long Term Capital Gains Tax is for investments that investors hold beyond three years. Also, these gains are taxable at 20% with indexation benefits.

Calculation of Gratuity in Case of Death of an Employee

In case of the death of an employee, the gratuity benefits are calculated based on the tenure of service of the employee. Similarly gratuity calculator online The amount is, however, subject to a maximum of Rs.20 lakh. so how is gratuity calculated in india The following table shows the rates at which the gratuity will be payable in case of death of an employee:

| Tenure of service | Amount payable towards gratuity |

|---|---|

| Less than a year | 2 * basis salary |

| 1 year or more but less than 5 years | 6 * basic salary |

| 5 years or more but less than 11 years | 12 * basic salary |

| 11 years or more but less than 20 years | 20 * basic salary |

| 20 years or more | Half of the basic salary for each completed six-monthly period. However, it is subject to a maximum of 33 times of the basic salary. |