When you borrow money, you have to pay it back on time. However, lenders expect to pay for their services and for the risks they incur when taking out a loan. In other words, you will not repay your loan. How to calculate interest on a loan You will repay the loan and an additional amount called interest. How are loan interest is calculated Rates on loans and EMI. how are loan interest calculated on loans Here is detailed information of loan Interest rates on EMI and Other?

What is Loan Interest?

Interest is the amount you pay for a mortgage. how loan interest is calculated on loans A $20,000 personal loan can pay off your entire $23,000 loan over the next five years. The additional $3,000 is interest.

When you pay off a delinquent loan. How are loan interest calculated on loans part of each payment is allocated to the loan amount (called the principal) and the other part to the interest rate. The interest rate paid by the borrower is determined by factors such as your loan history, income, loan amount, loan term, and amount of debt.

How to Calculate Loan Interest

How interest is calculated on loans To complete the repayment process, the lender uses an alternative method when paying interest. Calculating interest rates on a loan can be tricky because some types of interest require more calculations.

Simple Interest

If a lender uses the simple interest method, it’s easy to calculate loan interest on loans if you have the right information available. how loan interest is calculated Gather information like your principal loan amount, interest rate and a total number of months or years that you’ll be paying the loan.

Calculation

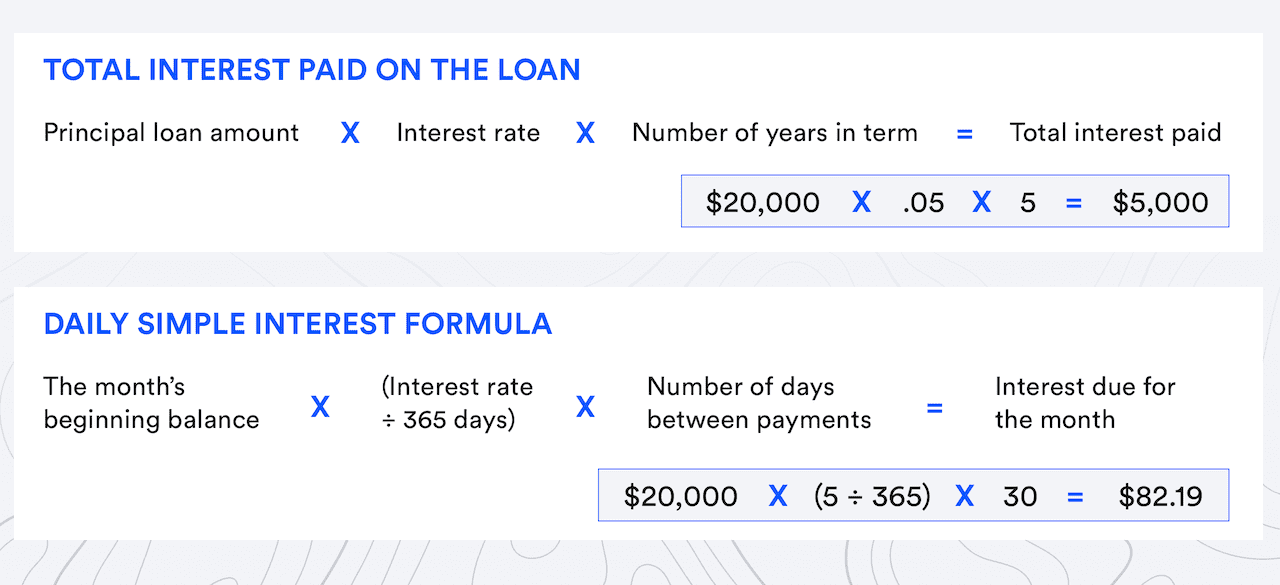

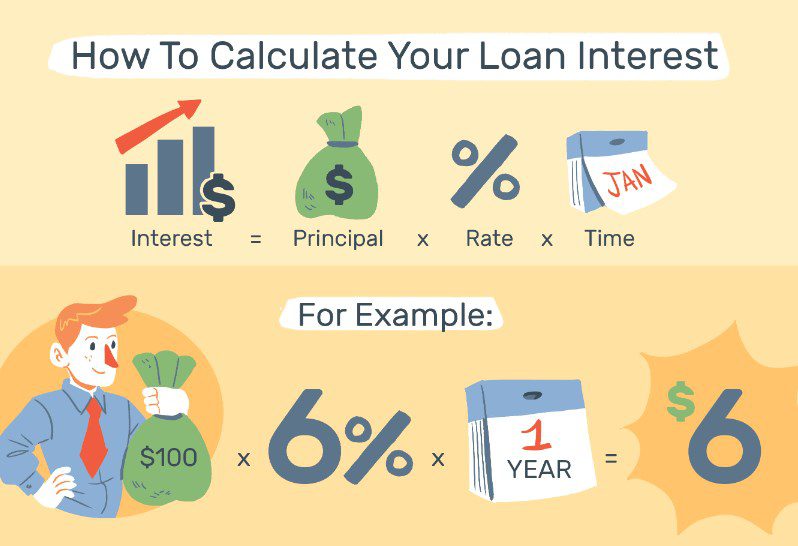

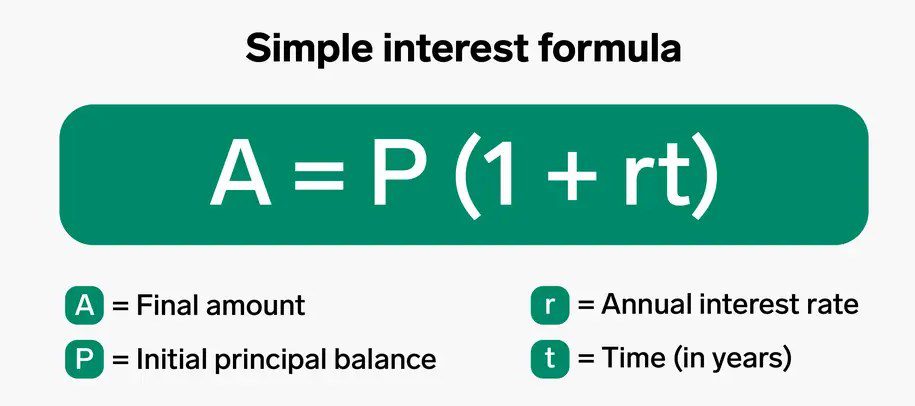

You can calculate your total interest by using this formula: how to calculate interest on a loan Principal loan amount x Interest rate x Time (aka Number of years in term) = Interest

For example, if you take out a five-year loan for $20,000 and the interest rate on the loan is 5 percent, the simple interest formula works as follows:

- $20,000 x .05 x 5 = $5,000 in interest

Amortizing loans

Many lenders charge interest based on an amortization schedule. Student loans, mortgages and auto loans often fit into this category. The monthly payment on these types of loans remains fixed and the loan is paid over time in equal installments, but the way the lender applies the payments you’re making to the loan balance changes over time.

With amortizing loans, the initial payments are generally interest-heavy, meaning less of the money you are paying each month goes toward paying your principal loan amount.

As time passes and you draw closer to your loan payoff date, however, the table turns. Toward the end of your loan, the lender applies the majority of your monthly payments to your principal balance and less toward interest fees.

Calculation

Here’s how to calculate the interest on an amortized loan:

- Divide your interest rate by the number of payments you’ll make that year. If you have a 6 percent interest rate and you make monthly payments, you would divide 0.06 by 12 to get 0.005.

- Multiply that number by your remaining loan balance to find out how much you’ll pay in interest that month. If you have a $5,000 loan balance, your first month of interest would be $25.

- Subtract that interest from your fixed monthly payment to see how much in principal you will pay in the first month. If your lender has told you that your fixed monthly payment is $430.33, you will pay $405.33 toward the principal for the first month. That amount gets subtract from your outstanding balance.

- For the following month, repeat the process with your new remaining loan balance, and continue repeating for each subsequent month.

Factors that can affect how much interest you pay.

Many factors can affect how much interest you pay for financing. Here are some of the primary variables that can impact how much you will pay over the life of the loan.

Loan amount

The amount of money you borrow (your principal loan amount) has a big influence on how much interest you pay to a lender. The more money you borrow, the more interest you’ll pay.

“For larger loans, the lender is assuming greater risk. Hence, the lender seeks a higher return,” says Jeff Arevalo, financial wellness expert for Green Path Financial Wellness.

If you borrow $20,000 over five years with a 5 percent interest rate, you’ll pay $2,645.48 in interest on an amortized schedule. If you keep all other loan factors the same (e.g., rate, term and interest type) but increase your loan amount to $30,000, the interest you pay over five years would increase to $3,968.22.

Also Read : Funny And Shocking Photoshop Mistakes That Should Never Have Been Posted Online

Takeaway: Don’t borrow more than you need to. Crunch the numbers first and determine exactly how much money you really require.

Interest rate

- Along with the amount of your loan, your interest rate is extremely important when it comes to figuring out the cost of borrowing. Poorer credit scores typically mean you will pay a higher interest rate.

- Building on the previous example ($20,000, five-year term, amortized interest), let’s compare a 5 percent loan with a 7 percent loan. On the 5 percent loan, the total interest cost is $2,645.48. If the interest rate increases to 7 percent, the cost of interest rises to $3,761.44.

- You’ll also need to find out whether your loan features a fixed interest rate or a variable interest rate. If it’s variable, your interest costs could rise over the course of your loan and affect your cost of financing.

- Takeaway: It may make sense to work on improving your credit score before borrowing money, which could increase your odds of securing a better interest rate and paying less for the loan.

Loan term

- A loan term is the amount of time a lender agrees to stretch out your payments. So if you qualify for a five-year auto loan, your loan term is 60 months. Mortgages, on the other hand, commonly have 15-year or 30-year loan terms.

- how loan interest is calculated The number of months it takes you to repay the money you borrow can have a significant impact on your interest costs.

- Shorter loan terms generally require higher monthly payments, but you’ll also incur less interest because you’re minimizing the repayment timeline. Longer loan terms may reduce the amount you need to pay each month, but because you’re stretching repayment out, the interest paid will be greater over time.

- “The problem with long-term loans is that they significantly increase the total cost of the loan,” says Michael Sullivan, a personal financial consultant for Take Charge America, a nonprofit credit counseling and debt management agency. “Long-term loans are the enemy of wealth building.”

Takeaway: Be sure to crunch the numbers ahead of time, figure out how much of a payment you can afford each month and find a loan term that makes sense for your budget and overall debt load.

Must Read : How To a Make a Resume – A Step-by-Step Guide

Repayment schedule

- How often you make payments to your lender is another factor to consider when calculating interest on a loan. Most loans require monthly payments (though weekly or biweekly payments exist too, especially in business lending). If you opt to make payments more frequently than once a month, there’s a chance you could save money.

- When you make payments more often, it can reduce the principal owed on your loan amount faster. In many cases, such as when a lender charge compounding interest, making extra payments could save you a lot.

- “If you’re going to make additional payments each month, check with your lender to make sure those payments are in fact going towards paying down the principal,” says Steve Sexton, financial consultant and CEO of Sexton Advisory Group. “If your loan is amortize, the more money paid to reduce the principal, the less interest you will pay.”

Takeaway: Don’t assume you can only make a single monthly payment on your loan. If you want to reduce the overall interest you pay to borrow money, it’s a good idea to make payments more often than required.

Repayment amount

The repayment amount is the dollar amount you’re require to pay on your loan each month.

In the same way that making loan payments more frequently has the potential to save you money on interest, how to calculate interest rate on loan paying more than the monthly minimum can also result in savings.

Takeaway: If you’re thinking about adding money to your monthly loan payment, ask the lender if the extra funds will count toward your principal. If so, this can be a great strategy to reduce your debt and lower the amount of interest you pay.

How to get the best loan interest rates

You may be able to improve your chances of obtaining the most favorable interest rate on a loan in a few ways. How are loan interest rates calculated

Improving your credit score

The most competitive interest rates are generally available to those with the highest credit scores. “Keep your credit score above 740,” says Jay Ferrans, president of JM Financial & Accounting Services. “Maintaining a good credit score will allow you to access better loan options because you’ve demonstrated credit trustworthiness.”

Opt for a shorter repayment timeline.

The best interest rates are always going to accompany the shortest-term loans. “If you can afford the payment that comes with a shorter loan. It is generally the best way to go,” Ferrans says.

Reduce your debt-to-income ratio.

Your debt-to-income (DTI) ratio is the amount of debt. You have to pay each month as a percentage of your gross monthly income. It is consider nearly as significant as your credit score when it comes to qualifying for a competitive loan. “Take steps to improve your debt-to-income ratio,” Sexton says. “By paying down your debt and lowering your DTI ratio. You could qualify for a lower interest rate with new debt or when you’re refinancing existing debt.”

What are the charges applicable on missing your personal loan EMI(s)?

On missing your personal loan EMI(s) payments. How are loan interest rates calculated You might have to pay these charges over and above the actual EMI payable:

- Penal interest charges: These charges are also know as overdue interest charges. And are levied on the overdue EMIs till the date of their repayment.

- Cheque/NACH/SI bounce charges: These charges are applicable when a personal loan EMI payment fails due to insufficient account balance. Or the closure of the account used for making EMI payments. This is usually a fixed charge levied each time an automated EMI deduction fails or the post-dated cheque bounces.

Can my personal loan EMI change during the loan tenure?

Yes, even though your personal loan EMI is usually a fixed amount. how to calculate interest rate on loan It can change during the loan tenure under certain circumstances:

- In case of loan prepayment: After prepaying your personal loan, you can either reduce. EMIs for the same tenure or reduce the tenure for the same EMIs. So, you can choose to reduce EMIs if current EMI amount is causing strain in your finances. Otherwise, reducing tenure is more beneficial as doing so will reduce your loan’s overall interest cost.

- In case of rate change in the floating interest rate: Some lenders offer personal loans at floating rate of interest. Which are link to their external benchmark rates. When these benchmark rates change, the rate of interest applicable also changes. In case of an increase in the floating interest rate. If the borrower permits, the lender may extend the loan tenure while keeping the EMIs same. How are loan interest rates calculated. In case the new tenure goes beyond the maximum period permitted, then the lender may increase your EMI.