Delhi, as the capital of the nation, has a very large population scattered in the main cities and suburbs. As one of the richest cities in this country, almost everyone has two -wheeled vehicles and/or four -wheeled vehicles used for personal or commercial purposes. Because of a large number of vehicles in the city. Online road tax payment Delhi the Delhi government collected significant revenue in the form of road taxes in Delhi from vehicle owners.

Payment of Delhi Road Tax: If you have a commercial vehicle then you have to pay your vehicle tax every year or monthly in Delhi. Every commercial vehicle needs to pay a road taxpayer in India, now the Parivahan portal makes all services online and easy to use for everyone. We will know how to pay your commercial road tax online such as cars, trucks, buses, and other vehicles. In this post guide to how to pay commercial road taxes? How to check payment status? And how do I re -verify road tax payments? How to calculate commercial vehicle tax?

Online Road Tax Payment in Delhi and Learn Step By Step Online Road Tax Payment Delhi

Online Road Tax Payment for Vehicle in Delhi

Here is info of Online Road tax payments for commercial vehicles are very easy steps to pay online using the Vahan Parivahan portal in Delhi. We provide all information about how to pay road taxes and check payment taxes. Portal Vahan Parivahan is a website that is very useful for every Indian person. Parivahan website offering online payments do not need to go to the RTO office.

Procedure to Pay Road Tax for Commercial Vehicle in Delhi

You want to pay your commercial vehicle road tax online please follow below process :

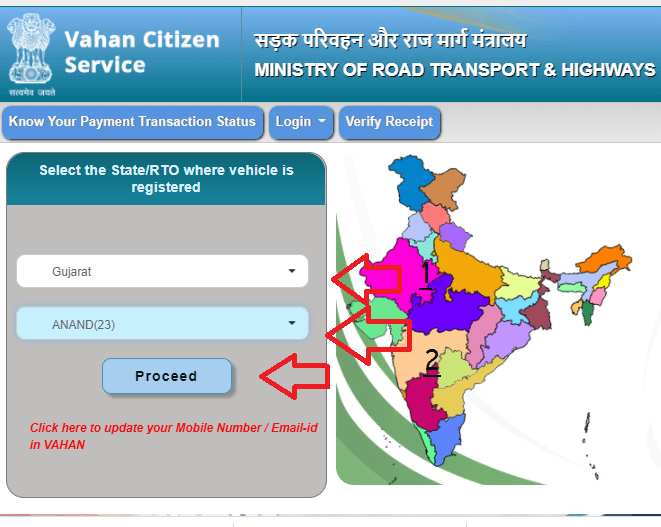

First go to visit vahan parivahan website https://vahan.parivahan.gov.in/vahanservice/, open official website then select state, RTO and click on proceed button.

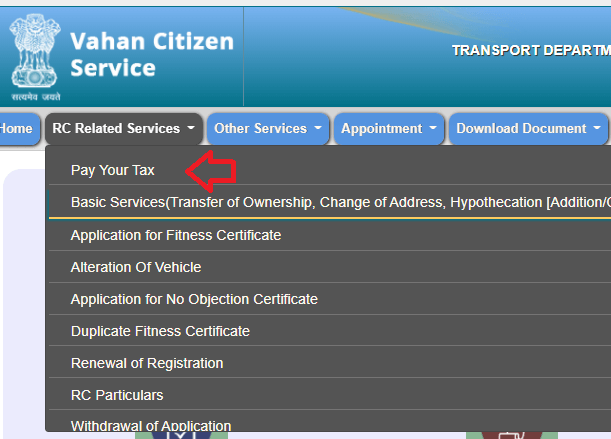

Main menu to select RC related service to pay your tax.

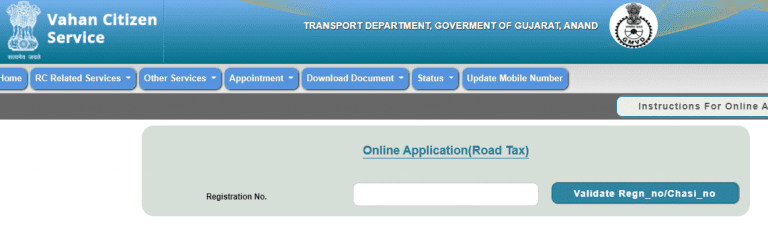

Now enter your register number of vehicle and check how much pending your vehicle tax show.

Pay your pending vehicle tax using online like a net banking or debit card. after successful made payment you can go to renewal of RC.

Procedure to Check Vehicle Tax Amount in Delhi

If you do not know how much pay your vehicle road tax then follow below process to calculate road tax.

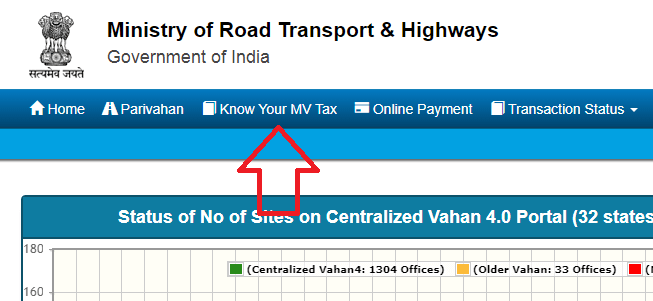

First go to parivahan vahan portal https://vahan.parivahan.gov.in, and select menu to “Know MV Tax”.

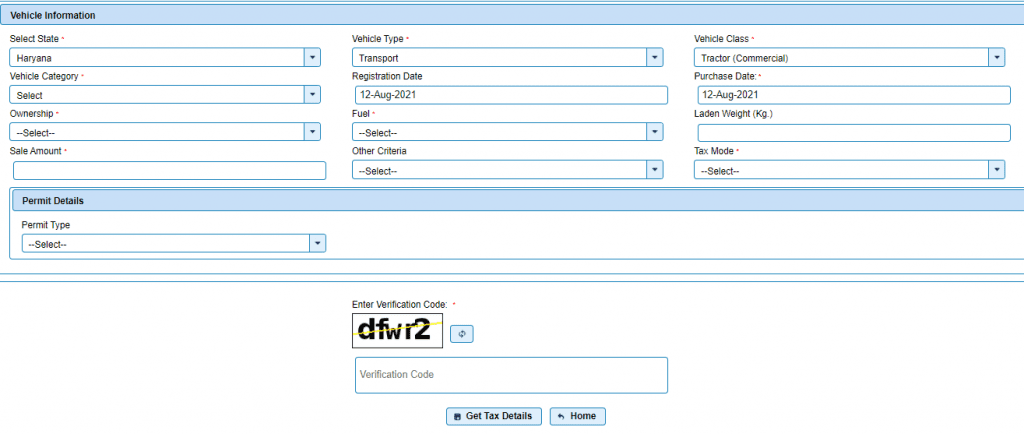

- Now enter your vehicle details :

- Select your state

- Select Vehicle types(Transport or Non-Transport)

- Select Vehicle Class

- Select Vehicle category

- Registration date

- enter all details relater your vehicle

Enter captcha code and click on get tax details button. show on screen your vehicle tax details and pay this amount.

Procedure of Check Road Tax Payment Status in Delhi

If you want to check your payment transaction status then follow below process.

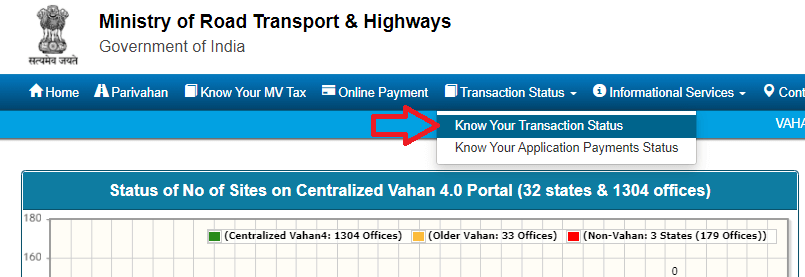

First go to Parivahan Vahan portal https://vahan.parivahan.gov.in, and select from menu to “Transaction Status” >> “Know Your Transaction Status”.

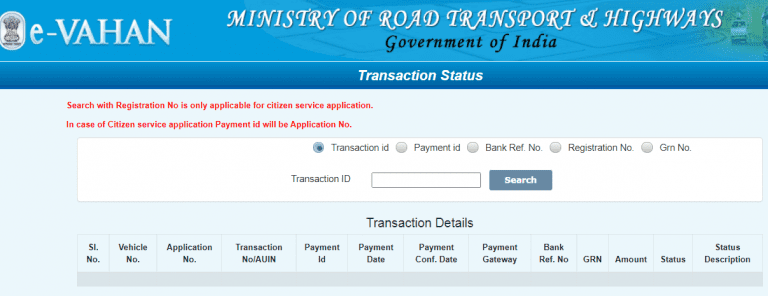

Now select any one option such as Transaction id, Payment id, Bank Ref. No., Registration No., Grn No. and enter details

Click on Search Button and get your payment status on your screen.

Procedure of Re-verify Your Failed Transaction

Note:- If the payment has been debited from the account and failed, then follow the steps below to re-verify your failed transactions.

Please login through the user/password ID provided by RTO

https://vahan.parivahan.gov.in/vahan/vahan/ui/eapplication/form_payment.xhtml

You will receive all transactions that failed to the application after logging in.

Click on the Re-verify Button.

Re -verification of failed transactions but the amount has been debited from Bank A/C.

Receipt will be generated if the response is successful after re-verifying, otherwise

Response from the bank side will be displayed.

Also Read: Aadhar Card Apply Online: How to do Registration for Aadhar Card

How is Road Tax Calculated in Delhi?

The amount of road tax that you have to pay depends on various factors decided by the government such as vehicle types, the purpose of using: commercial or personal, price, weight and age of the vehicle, etc. Some other factors that can be considered include the capacity of the engine, passenger capacity, and applicable tax according to the Delhi government tax rules. It should also be noted that commercial vehicles need to pay their road tax every year.

Two-Wheeler Road Tax in Delhi

The table given below lists all the information about road tax Delhi applicable on different types of two-wheelers:

| Type of Two-Wheeler | Applicable Road Tax (Annual) |

| Two-wheelers with less than 50cc power | ₹650 |

| Two-wheelers with more than 50cc power | ₹1,220 |

| Three-wheelers | ₹1,525 |

| Motorbikes with attached trailer | ₹1,525 + 465 |

Four-Wheeler Road Tax in Delhi

The four-wheeler road tax in Delhi is primarily calculated on the basis of the vehicle’s weight. To understand the four-wheeler road tax structure of Delhi in detail, you can refer to the table is given below:

| Weight of Four-Wheeler | Applicable Road Tax (Annual) |

| Four-wheelers less than 1000 kg | ₹3,815 |

| Four-wheelers between 1000-1500 kg | ₹4,880 |

| Four-wheelers between 1500-2000 kg | ₹7,020 |

| Four-wheelers above 2000 kg | ₹7,020 + ₹4,570 + (₹2,000 for every extra 100 kg) |

Road Tax for Transport/Commercial Vehicles in Delhi

Road tax for commercial vehicles in Delhi is levied based on their passenger capacity. Take a look at the table below for applicable road tax on different types of commercial vehicles:

| Passenger Capacity of Vehicle | Applicable Road Tax (Annual) |

| 2 passengers excluding the driver | ₹305 |

| 2-4 passengers, excluding the driver/conductor | ₹605 |

| 4-6 passengers, excluding the driver/conductor | ₹1,130 |

| 6-18 passengers, excluding the driver/conductor | ₹1,915 |

| More than 18 passengers, excluding the driver/conductor | ₹1,915 for 18 passengers + 280 for every additional passenger |

Road Tax for Goods Carrying Vehicles in Delhi

As part of commercial/transport vehicles related road tax, the Delhi government also applies road tax on goods-related vehicles. You can find the applicable road tax for goods-related vehicles in the table below:

| Weight Capacity of Goods Vehicles | Applicable Road Tax (Annual) |

| 1-tonne | ₹665 |

| Between 1-2 tonne | ₹940 |

| Between 2-4 tonne | ₹1,430 |

| Between 4-6 tonne | ₹1,915 |

| Between 6-8 tonne | ₹2,375 |

| Between 8-9 tonne | ₹2,865 |

| Between 9-10 tonne | ₹3,320 |

| More than 10-tonne | ₹3,790 |