How to link aadhaar with pan card. Here is Step by Step Detailed Information to link pan with aadhar card online

The last day to connect to Aadhaar-PAN is March 31, 2022. Under the new financial law, if you fail to connect your PAN to Aadhaar on time, you will be charged a late fee of up to Rs 1000. days.

You will now need to attach your Aadhaar account to your PAN to perform income-related activities, such as submitting your tax return. Anyone selected for the PAN and eligible for the Aadhaar number must be connected.

Aadhaar, also known as Unique Number, is a 12-digit number issued by the Unique Identification Authority of India (UIDAI). PAN is a 10-digit number provided by the Department of Revenue (I-T).

What is Aadhaar

How to Link PAN Card with Aadhaar Card?

It has become a mandatory process to link your PAN with Aadhaar. This is an important process because it will allow you to process your tax returns. how to link pan with aadhar card online. It is necessary to link your PAN with Aadhaar even if you are doing bank transactions in the amount of Rs 50,000 or more.

The process of linking your PAN with Aadhaar is very simple. We will take a look at some of the steps you can take to connect your PAN with Aadhaar.

PAN-Aadhaar Linking Deadline

Last date to connect Aadhaar and PAN extended by the Government

The government extended the last date to link the Aadhaar and the permanent account number (PAN) until March 31, 2022. Previously, the last date was September 30, 2021. The extension was granted due to difficulties they are facing because of the COVID-19 pandemic and to provide tax payers relief. how to link pan with aadhar card online

Ways to Linking PAN with Aadhaar

There are two ways through which you can link PAN and Aadhaar. These are:

1. Through the Income Tax e-filing website

2. Sending an SMS to 567678 or 56161

Linking PAN with Aadhaar Online ( Through the e-filing Website)

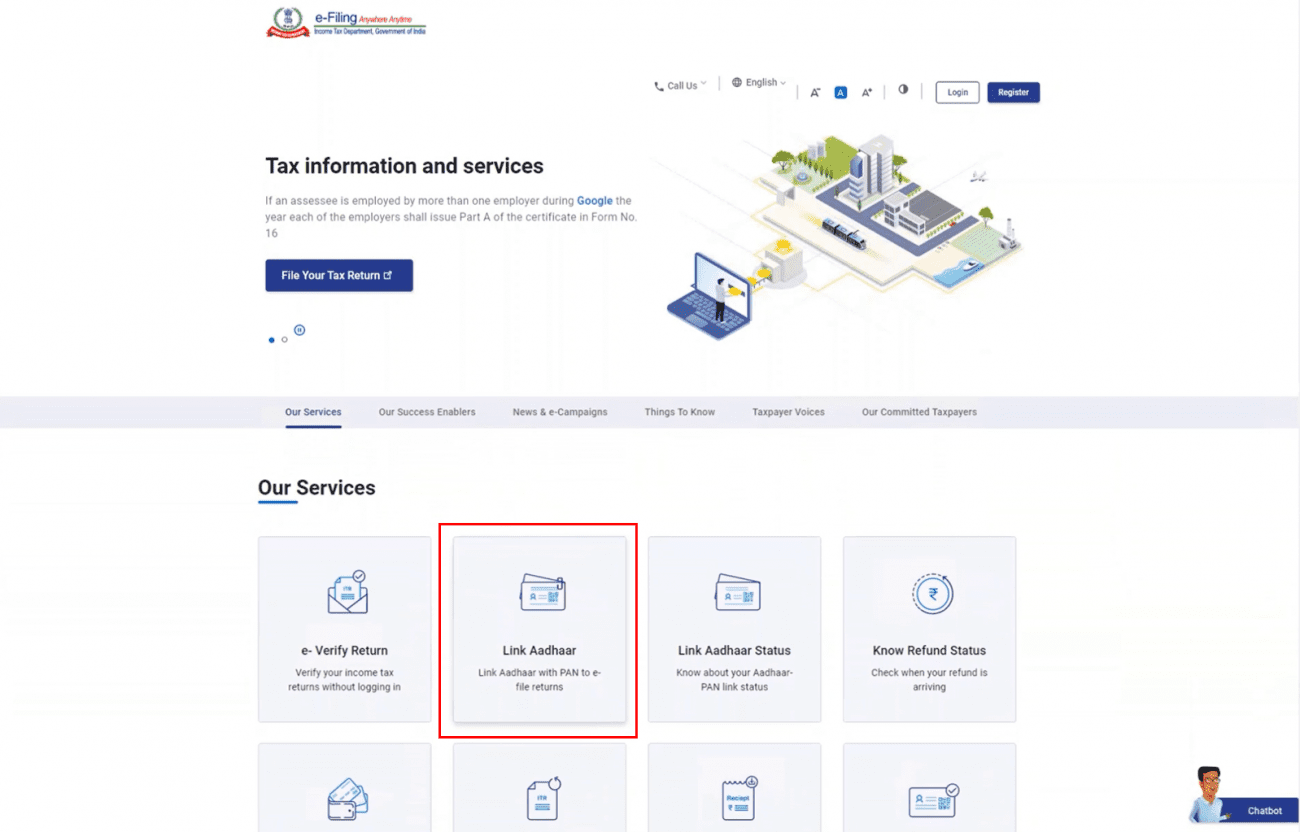

Step 1: Visit Income Tax Site by clicking on the

Step 2: Under ‘Quick Links’, click on ‘Link Aadhaar’. Provide the PAN, Aadhaar number, and name as mentioned in the Aadhaar card

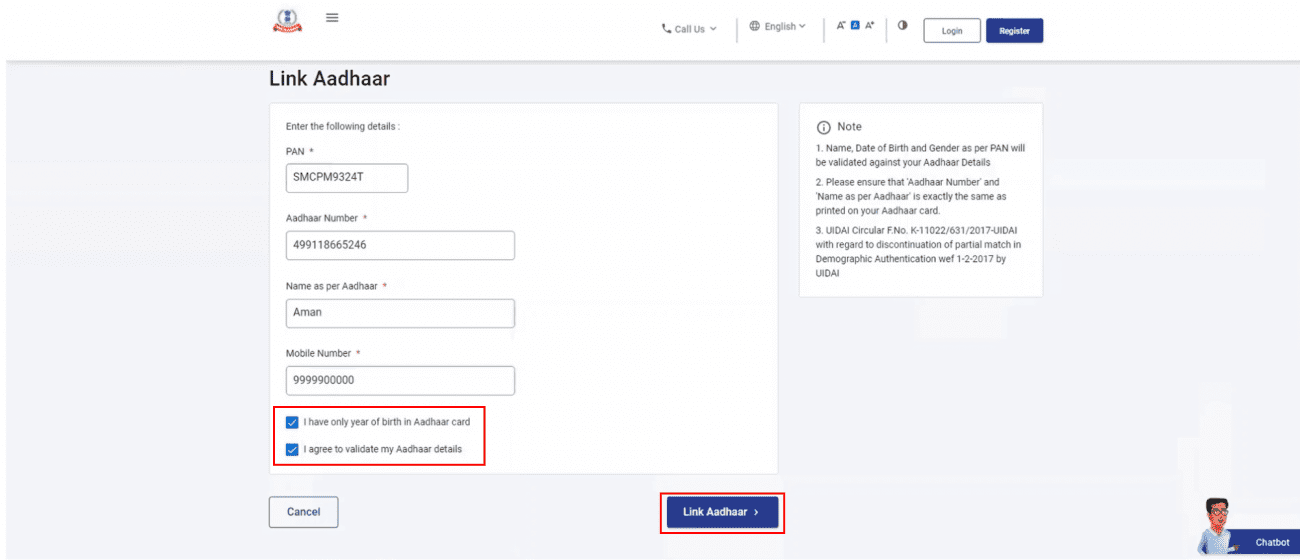

Step 3: Enter details such as PAN Number, Aadhaar number, your name on Aadhaar, and your mobile number, Tick the square if only the birth year in mentioned in the Aadhaar card, and also tick the box where you agree to get your Aadhaar details validate. Click on ‘Link Aadhaar’.

Step 4: Enter the Captcha code. (Visually challenged users can request for an OTP instead of the Captcha code. The OTP will be sent on the registered mobile number)

Detailed Steps

you can link your PAN with Aadhaar by following process:

a) Open the Income Tax e-filing portal

b) Register on it (if not already done). Your PAN (Permanent Account Number) will be your user id.

c) Log in by entering the User ID, password and date of birth.

d) A pop up window will appear, prompting you to link your PAN with Aadhaar. If not, go to ‘Profile Settings’ on Menu bar and click on ‘Link Aadhaar’.

e) Details such as name date of birth and gender will already be mentioned as per the PAN details.

f) Verify the PAN details on screen with the ones mentioned on your Aadhaar. Pls. note that if there is a mismatch, you need to get the same corrected in either of the documents.

g) If the details match, enter your Aadhaar number and click on the “link now” button.

h) A pop-up message will inform you that your Aadhaar has been successfully link to your PAN

i) You may also visit https://www.utiitsl.com/ OR https://www.egov-nsdl.co.in/ to link your PAN and Aadhaar.

Also Read : How to Download Covid Vaccination Certificate

Step-by-Step Guide

Link Aadhaar (Pre-Login and Post-Login)

Step 1: Pre-Login: Go to the e-Filing portal homepage, and click Link Aadhaar.

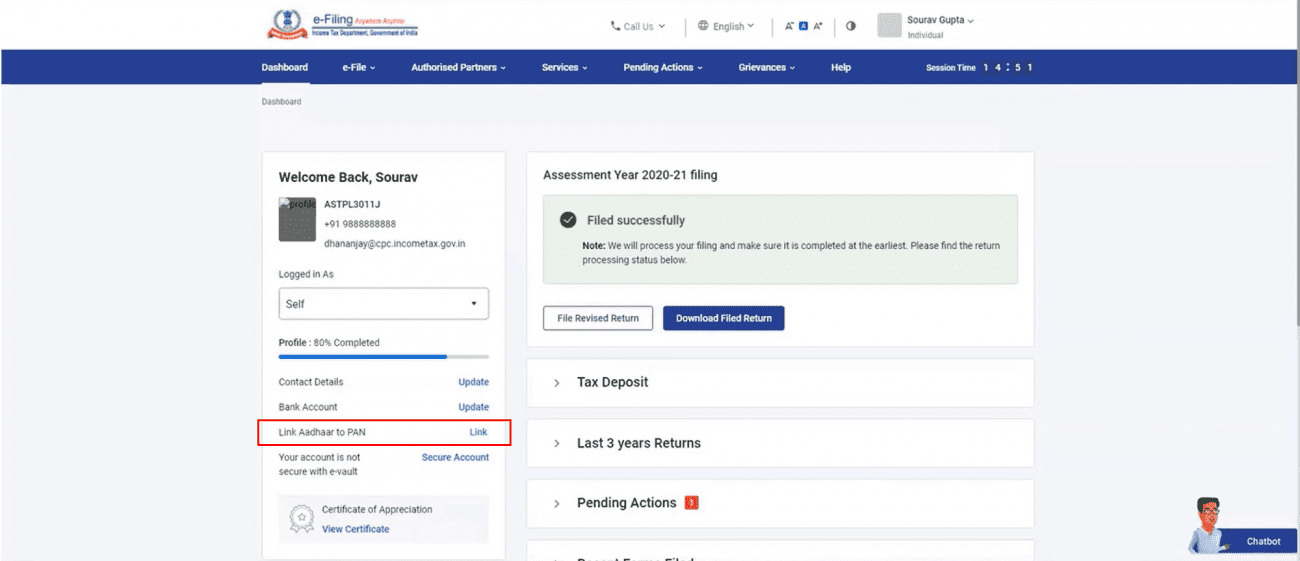

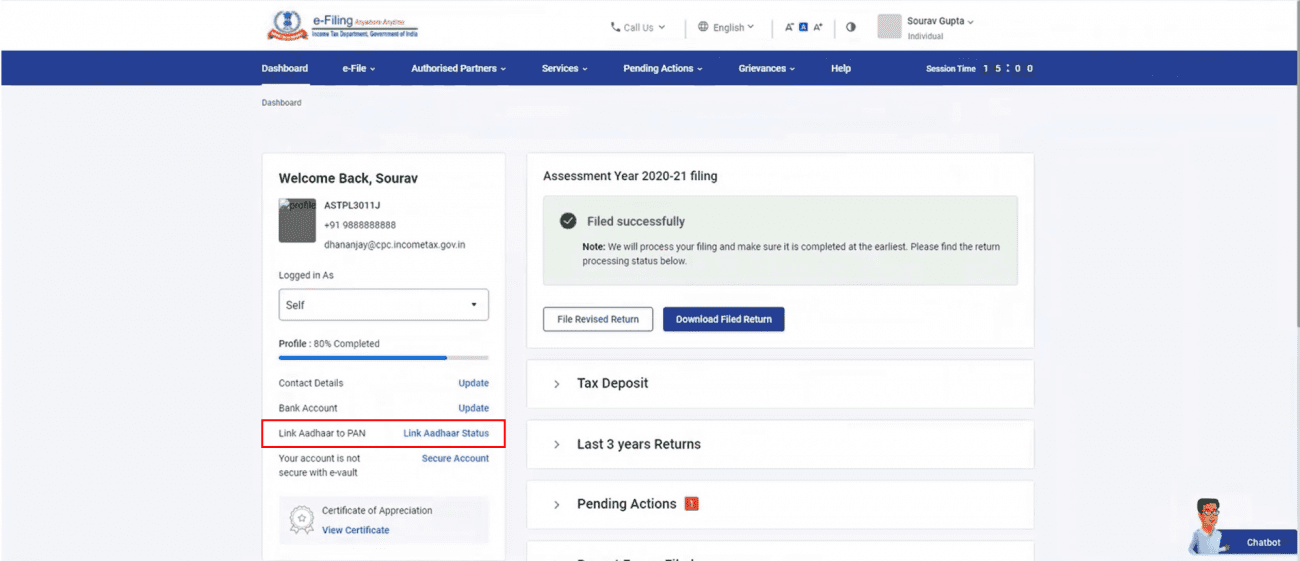

Step 1a: Post-Login: On your Dashboard, under the Link Aadhaar to PAN option, click Link Aadhaar.

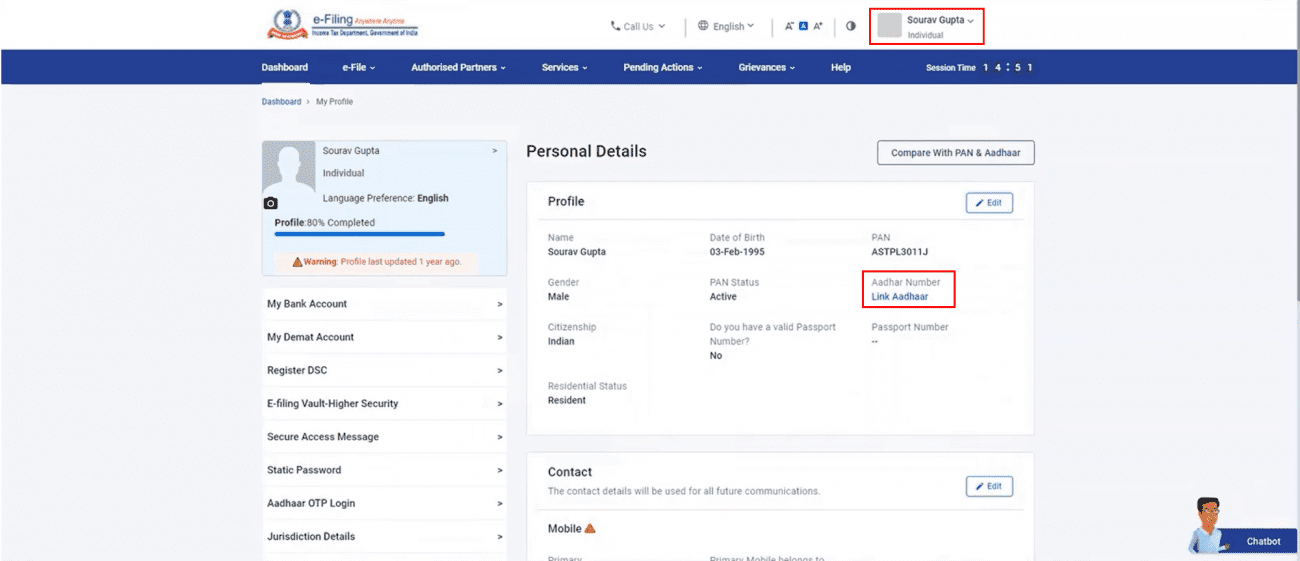

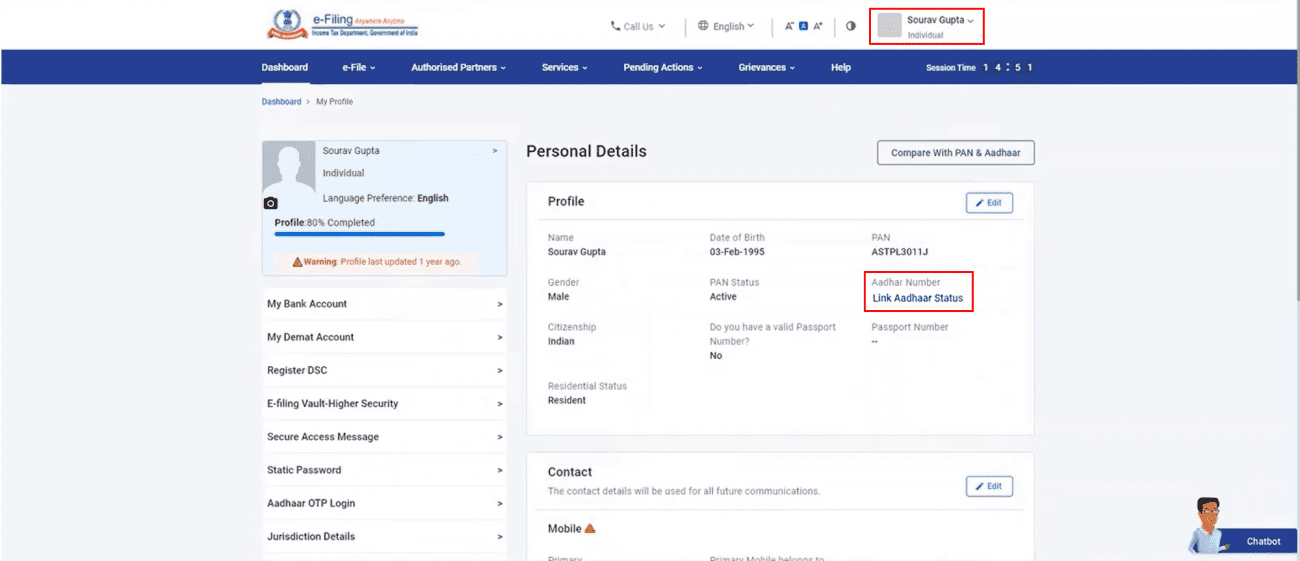

1b Step : Post-Login: You can also access this service from My Profile > Link Aadhaar.

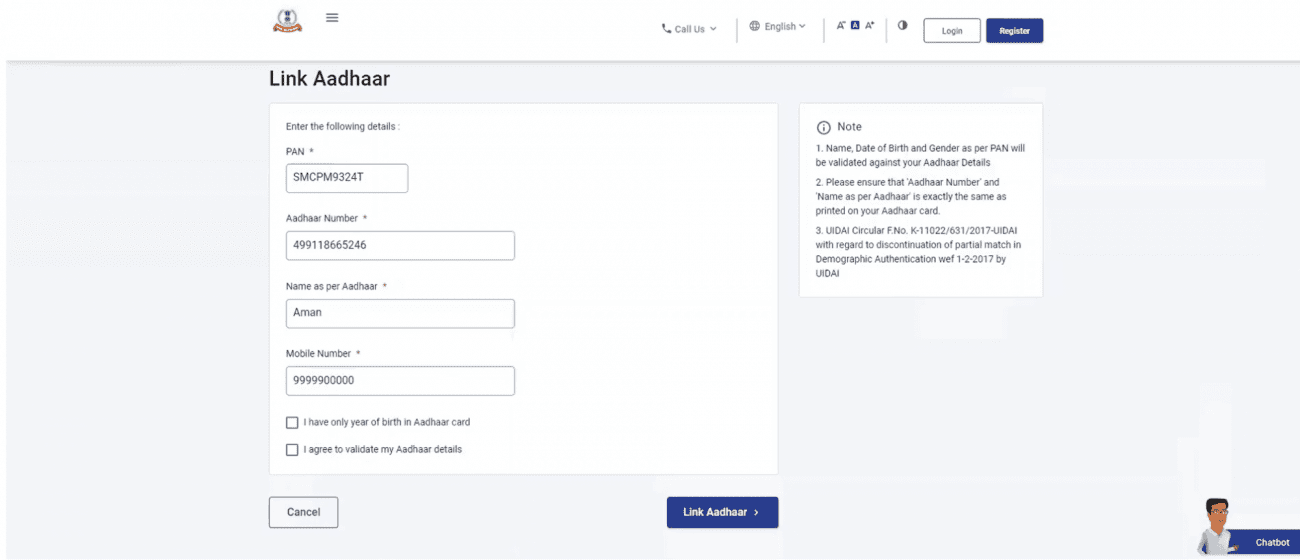

Step 2a: Pre-Login: On the Link Aadhaar page, enter your PAN, Aadhaar Number, Name as per Aadhaar and a valid Mobile Number.

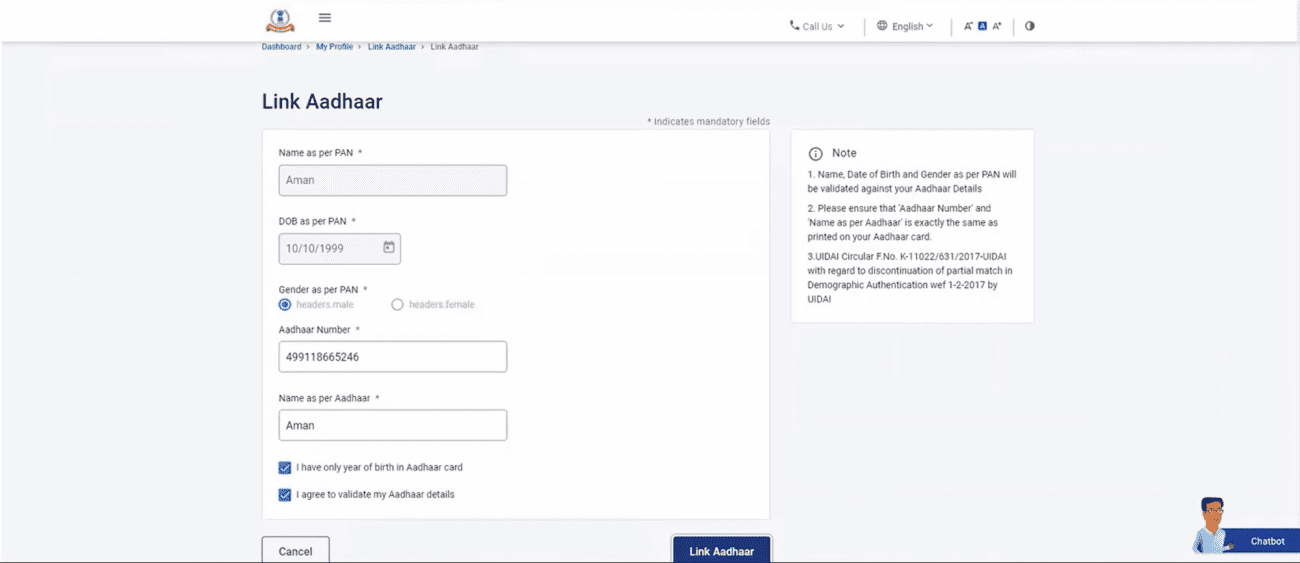

2b Step : Post-Login: On the Link Aadhaar page, your Name, Date of birth (DOB), and Gender as per PAN will be pre-fill and non-editable. Enter your Aadhaar Number and Name as per Aadhaar.

Step 3: If you have only year of birth in your Aadhaar card, click I have only year of birth in Aadhaar card. It is mandatory to select I agree to validate my Aadhaar details. Then, click Link Aadhaar.

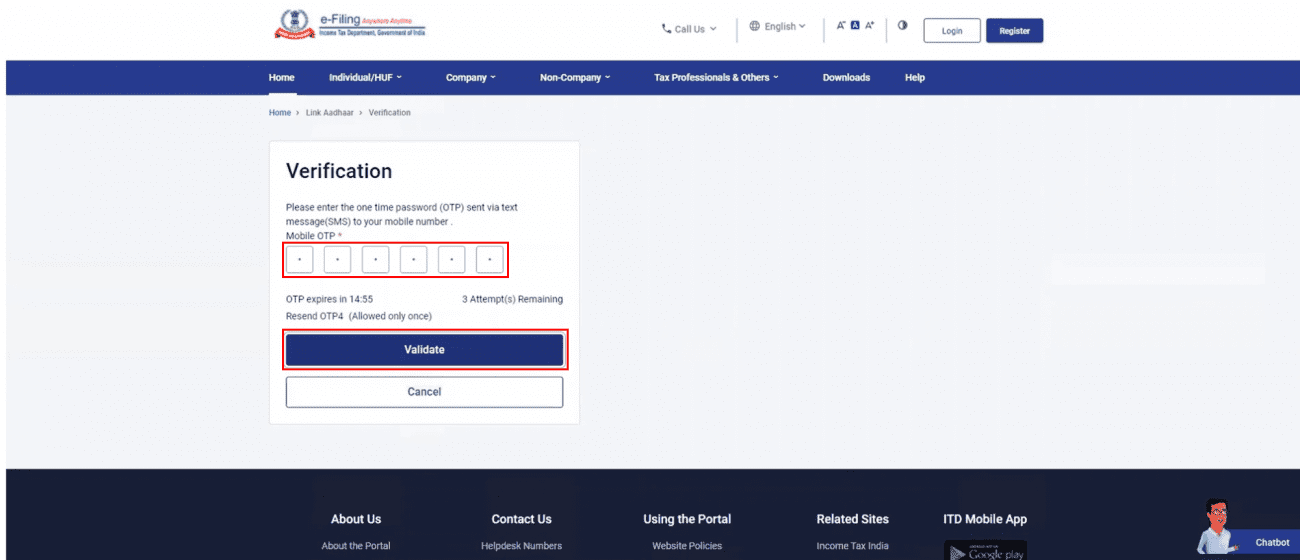

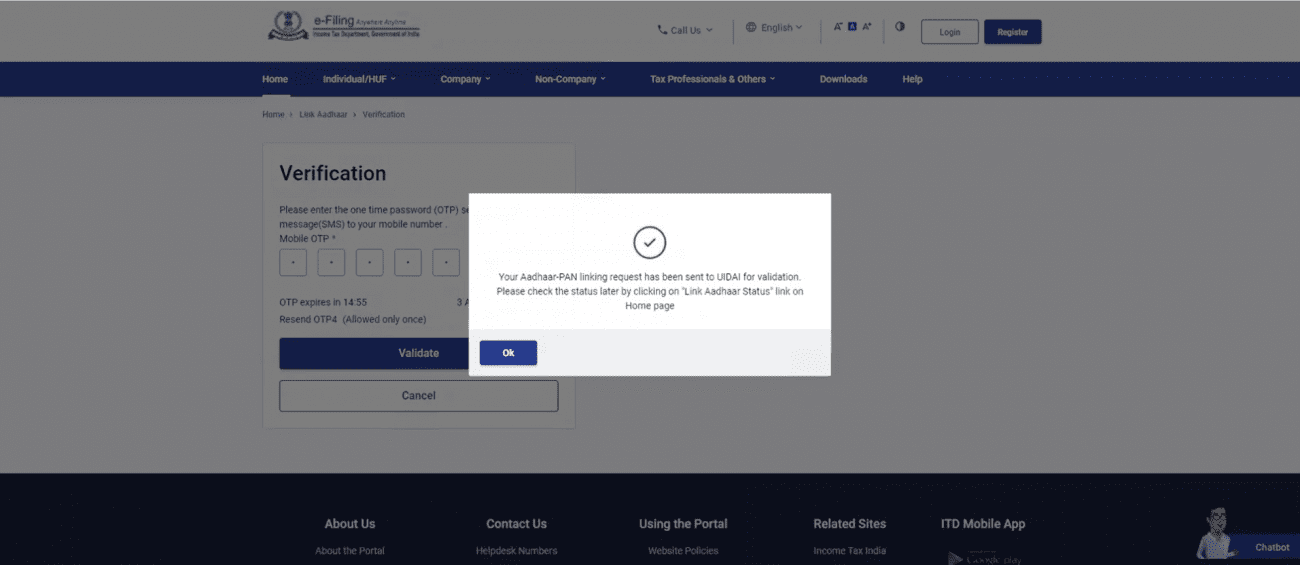

Step 4: Pre-Login: You will receive a 6-digit OTP on the mobile number you entered in Step 2a. On the Verification page, enter the Mobile OTP and click Validate. If you are using this service post-login, you won’t go through this step.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generate and sent.

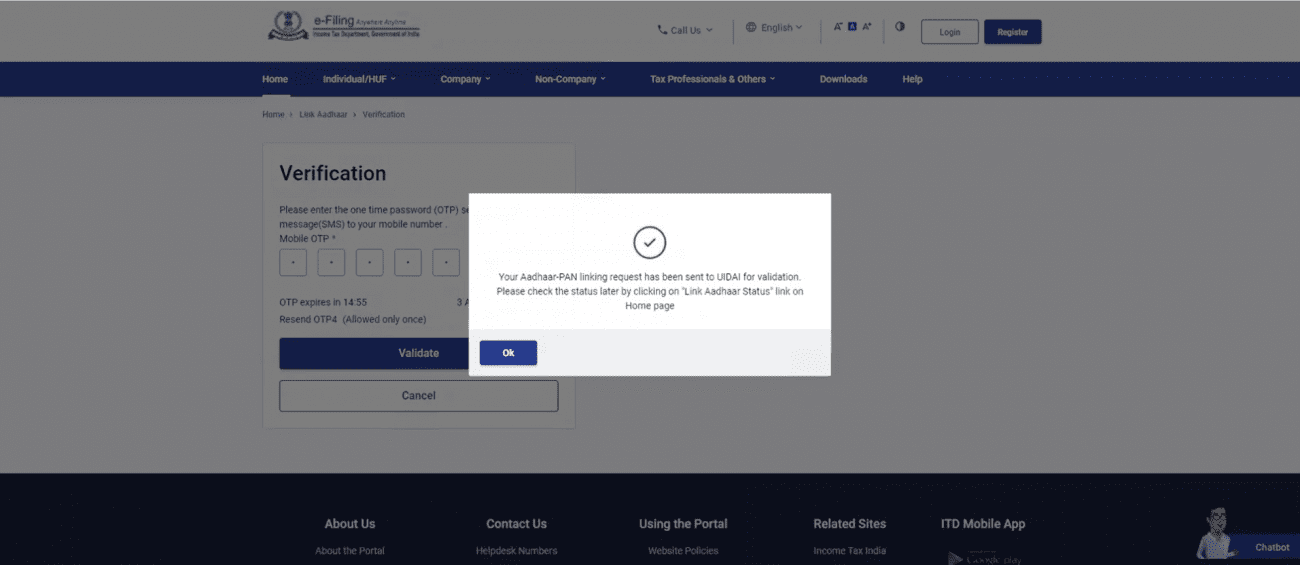

On success, you will get a message about your Aadhaar-PAN linking request sent to UIDAI.

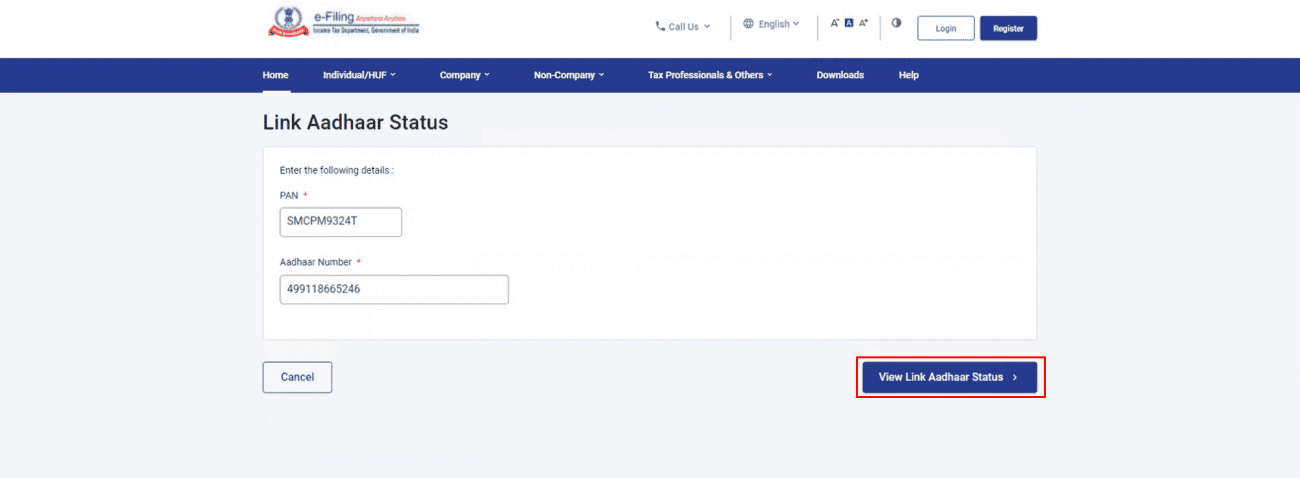

3.2 View Link Aadhaar Status (Pre-Login)

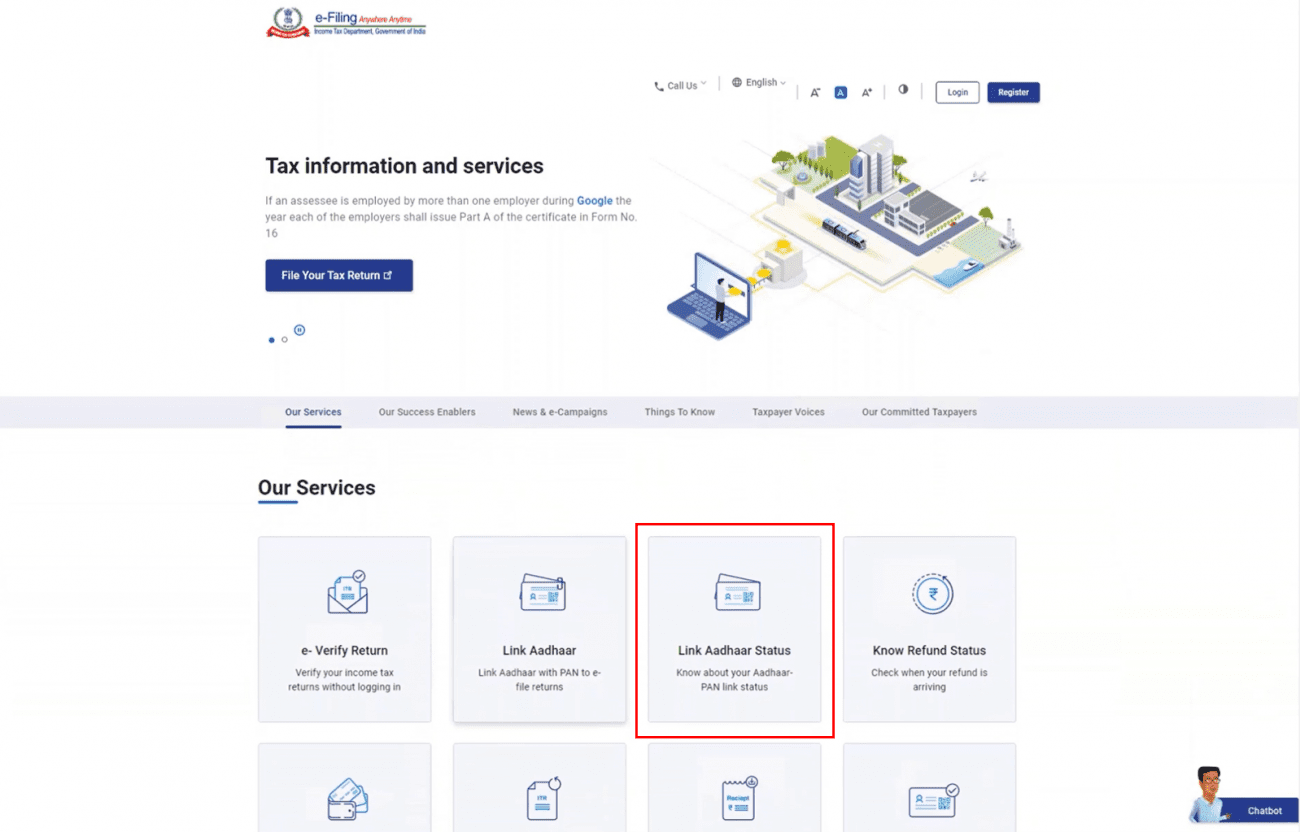

Step 1: On the e-Filing portal homepage, click Link Aadhaar Status.

Step 2: Enter your PAN and Aadhaar Number and click View Link Aadhaar Status.

On successful validation, a message will display your Link Aadhaar status.

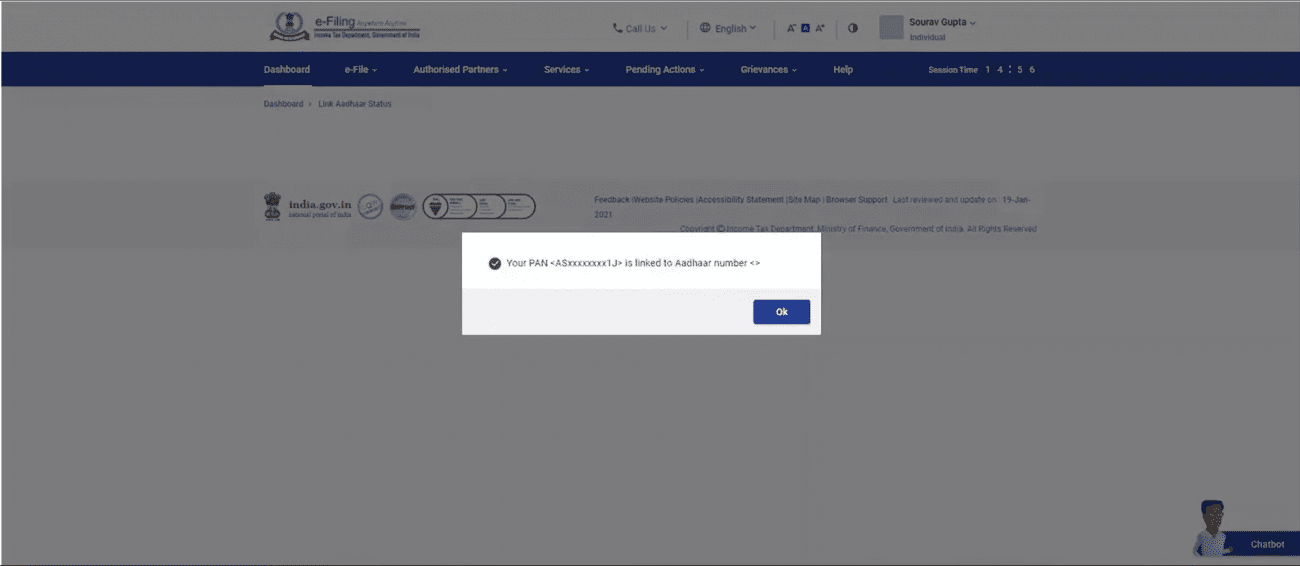

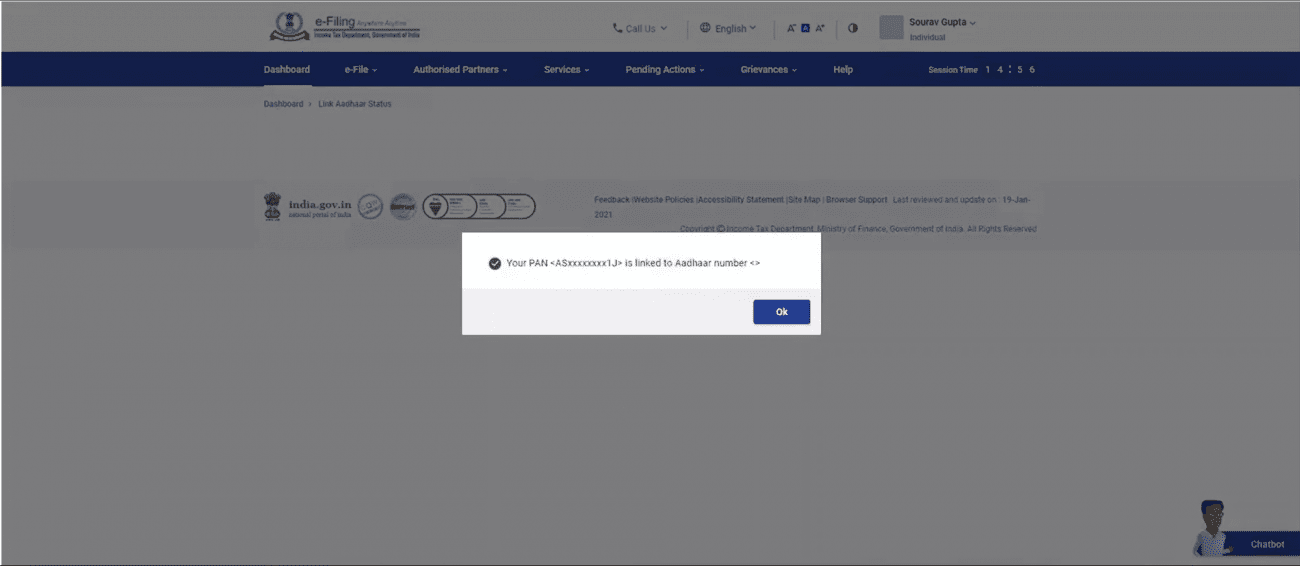

3.3 View Link Aadhaar Status (Post-Login)

Step 1a: Firstly On your Dashboard, click Link Aadhaar Status.

Step 1b: Alternatively, you can go to My Profile > Link Aadhaar Status.

Note:

- Firstly If the validation fails, so click Link Aadhaar on the Status page, and you will need to repeat the steps to link your PAN and Aadhaar.

- If your request to link PAN and Aadhaar is pending with UIDAI for validation, you will need to check the status later.

- Thirdly You may need to lodge a request (e-Nivaran) or contact the e-Filing Helpdesk to un-link Aadhaar and PAN if:

- your Aadhaar is link with some other PAN

- your PAN is link with some other Aadhaar

how to link pan with aadhar On successful validation, a message will display your Link Aadhaar status.

Importance of Linking PAN Card with Aadhaar Card

Both the PAN card as well as the Aadhaar card are unique identification cards that serve as proof of identity that are necessary for registration and verification purposes.

The government has urged all entities to link how to link pan with aadhar. This is done for the following purposes:

-

- Prevent Tax Evasion:

By linking the Aadhaar and PAN cards, the government will be able to keep tabs on the taxable transactions of a particular individual or entity, whose identity and address will be verified by his Aadhaar card. This will effectively mean that every taxable transaction or activity will be record by the government.

As a result, the government will already have a detailed record of all the financial transactions that would attract tax for each entity, making tax evasion a thing of the past.

-

- Multiple PAN Cards:

Another reason for linking PAN with Aadhaar is to reduce the occurrence of individuals. In other words or entities applying for multiple PAN cards in an effort to defraud the government and avoid paying taxes.

By applying for more than one PAN card, After that an entity can use one of the cards for a certain set of financial transactions and pay taxes applicable for those. Meanwhile, the other PAN card can be use for accounts or transactions that the entity wishes to conceal from the Income Tax department, thereby avoiding paying tax on them.

By linking the PAN and Aadhaar card. how to link pan with aadhar the government will be able to link the identity of an entity through his/her Aadhaar card, and subsequently have details of all financial transactions made through the linked PAN card. If there are multiple PAN cards register under the same name, how to link pan with aadhar the government will be able to identify the same and take corrective action.